Uncovering the Top Trading Strategies for Success in the Australian Stock Market

Stock trading in Australia is a popular investment option for many individuals looking to grow their wealth and take advantage of market fluctuations. With a strong and stable economy, a well-regulated financial system, and access to global markets, Australia provides ample opportunities for investors to trade stocks and potentially generate significant returns.

Overview of Stock Trading in Australia

Stock trading in Australia is primarily conducted on the Australian Securities Exchange (ASX), which is one of the largest and most established stock exchanges in the Asia-Pacific region. The ASX lists a wide range of stocks across various sectors, including financials, resources, healthcare, technology, and consumer goods. Investors can purchase and sell shares in publicly listed companies through stockbrokers and online trading platforms.

Key Strategies for Trading Stocks

Successful stock trading requires a solid understanding of market dynamics, a disciplined approach, and an effective trading strategy. Some key strategies that traders commonly use in Australia include:

1. Fundamental Analysis: Analyzing company financials, industry trends, and economic indicators to assess the intrinsic value of a stock.

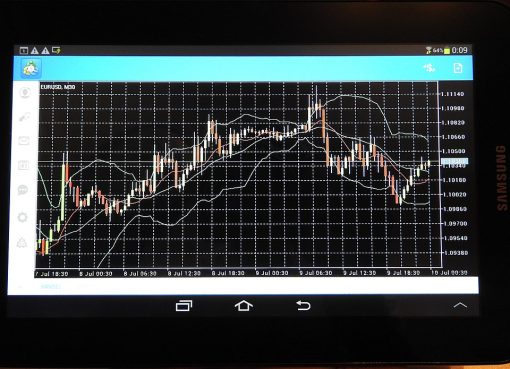

2. Technical Analysis: Studying price charts, trends, and trading volumes to identify patterns and predict future price movements.

3. Risk Management: Setting stop-loss orders, diversifying investments, and managing position sizing to limit losses and protect capital.

4. Long-Term Investing: Holding stocks for the long term to benefit from capital appreciation and dividend payouts.

5. Day Trading: Making short-term trades within a single trading day to capitalize on intraday price movements.

Current Market Trends

The Australian stock market has seen significant volatility in recent years, driven by global economic uncertainties, geopolitical events, and industry-specific developments. Some current trends in the Australian stock market include:

1. Growth of Technology Stocks: Australian tech companies, such as Atlassian, Afterpay, and WiseTech Global, have gained traction in the global market, attracting investor interest.

2. Resource Sector Resilience: The mining and energy sectors in Australia have shown resilience amid commodity price fluctuations, driven by strong demand from China and other emerging markets.

3. ESG Investing: Environmental, Social, and Governance (ESG) considerations are increasingly influencing investor decisions, leading to the rise of sustainable investing practices in Australia.

Trading Techniques and Stock Analysis Methods

In addition to fundamental and technical analysis, traders in Australia employ various trading techniques to maximize profits and minimize risks. Some common trading techniques include:

1. Momentum Trading: Buying stocks that are trending upwards in price and selling them before the trend reverses.

2. Contrarian Trading: Betting against the prevailing market sentiment by buying undervalued stocks or short-selling overvalued stocks.

3. Event-driven Trading: Investing based on corporate events, such as earnings reports, mergers, acquisitions, or regulatory changes.

Role of Trading Platforms

Trading platforms play a crucial role in facilitating stock trading in Australia, providing investors with access to real-time market data, research tools, and trading functionality. Some popular trading platforms in Australia include CommSec, IG Markets, and CMC Markets. These platforms offer a range of services, including online trading, margin trading, options trading, and international trading.

Market Performance and Investment Opportunities

Despite market uncertainties, the Australian stock market has shown resilience and continues to offer attractive investment opportunities for traders. With a diverse range of companies spanning various industries, investors can capitalize on emerging trends and growth sectors to build a diversified portfolio. Some sectors with promising investment opportunities in Australia include:

1. Healthcare: With an aging population and increasing healthcare expenditure, healthcare stocks in Australia are well-positioned for growth.

2. Renewable Energy: As the world transitions towards clean energy sources, Australian renewable energy companies offer promising investment prospects.

3. Financial Technology (Fintech): The fintech sector in Australia is witnessing rapid growth, driven by technological innovation and changing consumer preferences.

Tips for Successful Stock Trading in Australia

To succeed in stock trading in Australia, investors should adopt a disciplined approach, stay informed about market developments, and continuously improve their trading skills. Some tips for successful stock trading in Australia include:

1. Conduct thorough research and stay abreast of company news and market trends.

2. Develop a trading plan with clear entry and exit points, risk management strategies, and performance objectives.

3. Start with a small investment capital and gradually increase exposure as you gain experience and confidence.

4. Learn from seasoned traders, attend seminars, and leverage educational resources to enhance your trading knowledge.

5. Stay patient and maintain a long-term perspective, avoiding impulsive decisions based on short-term market fluctuations.

In conclusion, stock trading in Australia presents ample opportunities for investors to participate in the financial markets and potentially generate significant returns. By adopting sound trading strategies, conducting thorough research, and staying disciplined in their approach, traders can navigate the Australian stock market efficiently and achieve their investment goals. With access to advanced trading platforms, diverse investment opportunities, and a supportive regulatory environment, Australia offers a conducive ecosystem for individuals looking to engage in stock trading and build wealth over the long term.

Leave a Comment