The Best Trading Strategies for Australian Stocks: Tips for Picking Winners

Stock trading in Australia is a popular investment strategy that allows individuals to buy and sell shares of publicly traded companies on the country’s stock exchange. With a well-regulated financial market and a stable economy, Australia provides a conducive environment for investors looking to participate in stock trading.

Overview of Stock Trading in Australia:

The Australian Securities Exchange (ASX) is the primary stock exchange where most of the trading activity takes place in Australia. The ASX lists a wide range of companies from various sectors, including mining, finance, technology, and healthcare. Investors can buy and sell shares of these companies through brokerage accounts or online trading platforms.

Key Strategies for Trading Stocks:

1. Fundamental Analysis: This strategy involves evaluating a company’s financials, management team, industry trends, and macroeconomic factors to determine the intrinsic value of its stock. Fundamental analysis helps investors identify undervalued or overvalued stocks for long-term investment.

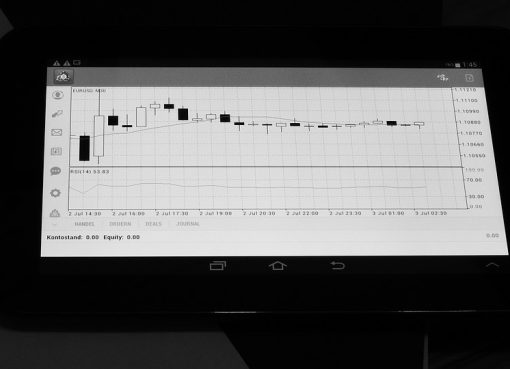

2. Technical Analysis: Technical analysis involves studying stock price charts, volume trends, and technical indicators to predict future price movements. Traders use charts and patterns to identify entry and exit points for short-term trading strategies.

3. Momentum Trading: Momentum trading involves capitalizing on the market’s direction by buying stocks that are trending upward and selling stocks that are trending downward. This strategy requires quick decision-making and a keen understanding of market sentiment.

Current Market Trends:

In recent years, the Australian stock market has seen significant growth, with technology companies and mining stocks leading the way. The rise of renewable energy and e-commerce sectors has also generated interest among investors looking for high-growth opportunities. As the global economy recovers from the impact of the COVID-19 pandemic, Australian stocks are expected to continue performing well.

Trading Techniques and Platforms:

There are several trading techniques that investors can use to trade stocks in Australia, including day trading, swing trading, and position trading. Day traders aim to profit from short-term price fluctuations, while swing traders hold positions for a few days to weeks. Position traders hold stocks for the long term, based on fundamental analysis.

Investors can access the Australian stock market through online trading platforms offered by brokerage firms. These platforms provide real-time market data, research tools, and order execution capabilities to help investors make informed decisions. Some popular trading platforms in Australia include CommSec, IG Markets, and CMC Markets.

Successful Stock Trading Tips:

1. Stay Informed: Keep up with market news, company announcements, and economic indicators that can impact stock prices.

2. Diversify: Spread your investments across different sectors and asset classes to reduce risk and maximize returns.

3. Set Realistic Goals: Have a clear investment plan with defined goals and risk tolerance levels to avoid emotional decision-making.

In conclusion, stock trading in Australia offers investors a range of opportunities to grow their wealth and build a diversified portfolio. By understanding key strategies, market trends, and trading techniques, investors can navigate the stock market with confidence and achieve success in their trading endeavors. With the right knowledge and tools, anyone can participate in stock trading in Australia and potentially reap the benefits of a thriving market.

Leave a Comment