From Beginner to Expert: Mastering Stock Trading in Australia

Trading stocks in Australia is a popular way for investors to build wealth and achieve financial goals. The Australian stock market, also known as the Australian Securities Exchange (ASX), is one of the top stock exchanges in the world, offering a diverse range of investment opportunities. In this article, we will provide a comprehensive overview of stock trading in Australia, including key strategies, trading techniques, market trends, and tips for successful trading.

Overview of Stock Trading in Australia

The Australian stock market is a dynamic and sophisticated market that provides investors with access to a wide range of companies across various sectors. The ASX is home to some of Australia’s largest companies, including major banks, mining companies, technology firms, and retailers. Investors can buy and sell shares in these companies through a stockbroker or online trading platform.

Key Strategies for Trading Stocks

There are several key strategies that investors can use when trading stocks in Australia. These strategies include:

1. Long-term Investing: This strategy involves holding onto stocks for an extended period, usually several years, in the hopes that the value of the stocks will increase over time. Long-term investing is ideal for investors looking for steady growth and income from dividends.

2. Day Trading: Day trading involves buying and selling stocks within the same trading day to take advantage of short-term price movements. Day traders often use technical analysis and chart patterns to make quick trading decisions.

3. Value Investing: Value investing involves buying stocks that are undervalued by the market and holding onto them until their true value is recognized. Value investors look for stocks with strong fundamentals and relatively low prices compared to their intrinsic value.

4. Growth Investing: Growth investing focuses on companies with high growth potential and strong earnings growth. Growth investors are willing to pay a premium for these companies in the hopes of achieving high returns over time.

Trading Techniques and Stock Analysis Methods

There are various trading techniques and stock analysis methods that investors can use to make informed trading decisions. Some common techniques include:

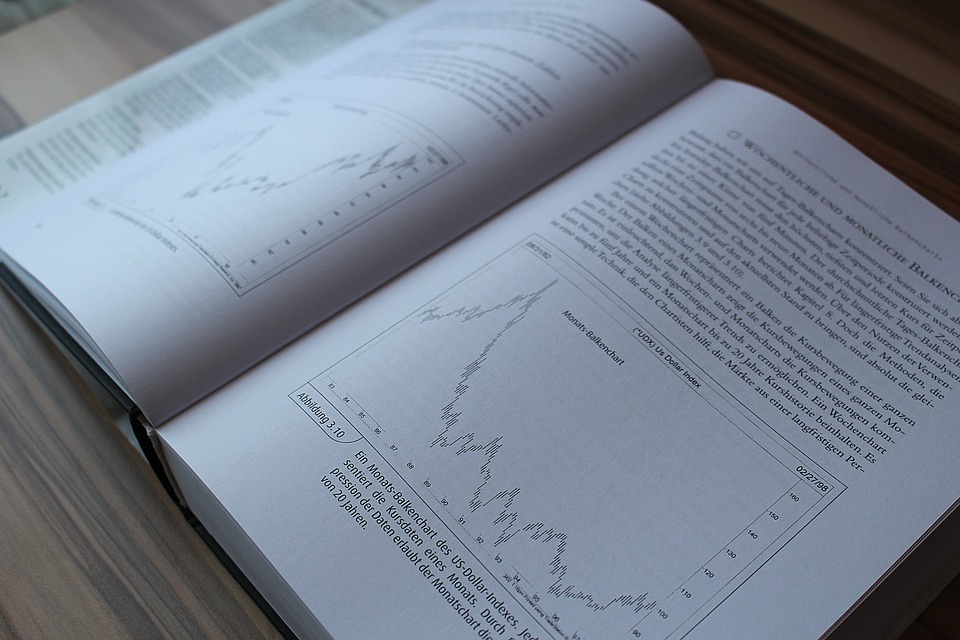

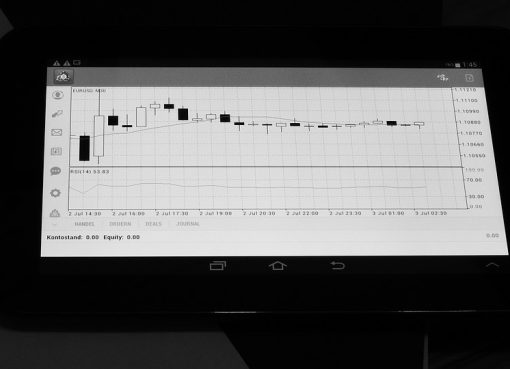

1. Technical Analysis: Technical analysis involves studying past price movements and volume data to predict future price trends. Technical analysts use charts and indicators to identify patterns and trends in stock prices.

2. Fundamental Analysis: Fundamental analysis involves evaluating a company’s financial health, performance, and competitive position to determine its intrinsic value. Fundamental analysts look at factors such as earnings, revenue, cash flow, and industry trends to make investment decisions.

3. Sentiment Analysis: Sentiment analysis involves gauging market sentiment and investor emotions to predict price movements. Sentiment analysis looks at factors such as news headlines, social media trends, and market sentiment indicators to assess investor sentiment.

Role of Different Trading Platforms

There are several trading platforms available to investors in Australia, including online brokers, trading apps, and trading software. These platforms provide investors with access to real-time market data, research tools, and trading capabilities. Some popular trading platforms in Australia include CommSec, IG, CMC Markets, and SelfWealth.

Market Performance and Investment Opportunities

The Australian stock market has performed well in recent years, with strong gains in key sectors such as technology, healthcare, and mining. Despite market volatility and economic uncertainty, there are still plenty of investment opportunities available to investors in Australia. Some sectors to watch include renewable energy, FinTech, and biotechnology.

Tips for Successful Stock Trading in Australia

To be successful in trading stocks in Australia, investors should consider the following tips:

1. Do Your Research: Before buying or selling stocks, do thorough research on the company, sector, and market trends. Stay informed about economic indicators, earnings reports, and news events that may impact stock prices.

2. Diversify Your Portfolio: Diversification is key to managing risk and maximizing returns. Spread your investments across different sectors, industries, and asset classes to reduce exposure to individual stock risk.

3. Set Realistic Goals: Set clear investment goals, such as target returns, time horizon, and risk tolerance. Stick to your investment plan and avoid making emotional decisions based on market fluctuations.

4. Stay Disciplined: Maintain a disciplined approach to trading stocks by following your trading plan, managing risk, and staying patient during market downturns. Avoid chasing hot stocks or making impulsive decisions.

In conclusion, trading stocks in Australia offers investors a wealth of opportunities to build a diversified and profitable investment portfolio. By utilizing key strategies, trading techniques, and analysis methods, investors can make informed trading decisions and achieve their financial goals. With the right research, discipline, and focus on market trends, investors can succeed in the dynamic world of stock trading in Australia.

Leave a Comment