Evaluating Australian Stocks: A Step-by-Step Guide to Effective Stock Analysis

Trading stocks in Australia can be a lucrative endeavor for investors looking to capitalize on the country’s growing economy and robust financial markets. With its stable political climate and strong regulatory framework, Australia offers a conducive environment for stock trading. In this article, we will explore the fundamentals of trading stocks in Australia, key strategies for success, current market trends, and tips for navigating the stock market effectively.

Overview of Stock Trading in Australia

Stock trading in Australia is dominated by the Australian Securities Exchange (ASX), which is the primary stock exchange in the country. The ASX lists a wide range of companies across various industries, providing investors with ample opportunities to diversify their portfolios. Trading stocks on the ASX can be done through a broker or online trading platform, making it accessible to both individual and institutional investors.

Key Strategies for Trading Stocks

Successful stock trading requires a solid understanding of market fundamentals, technical analysis, and risk management. Some key strategies for trading stocks in Australia include:

1. Fundamental Analysis: This involves evaluating a company’s financial performance, management team, industry outlook, and competitive position. By conducting thorough research, investors can make informed decisions about which stocks to buy or sell.

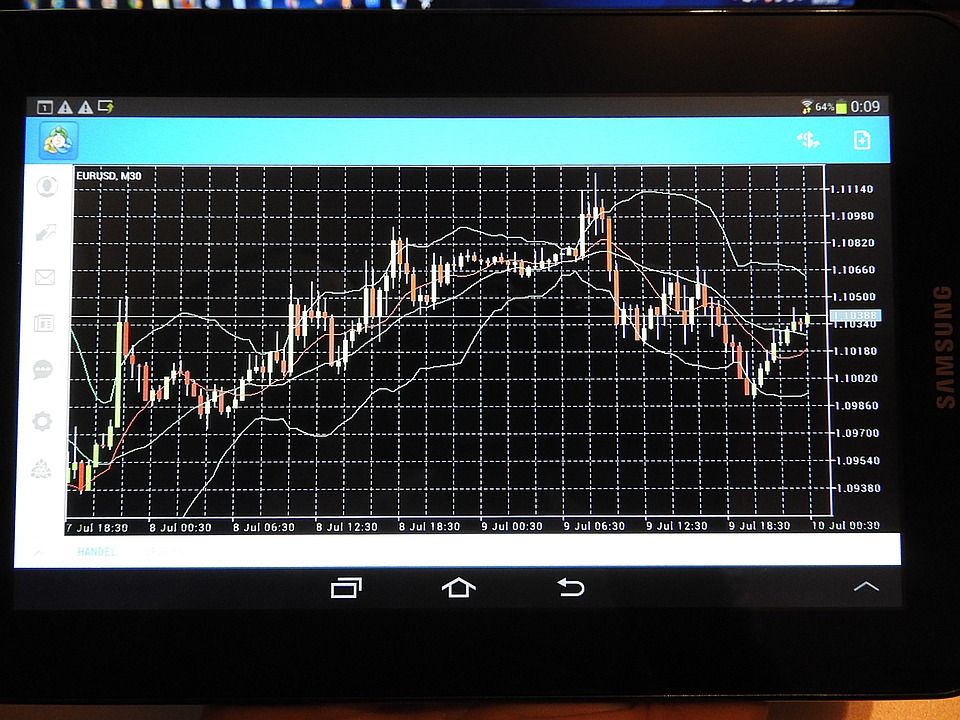

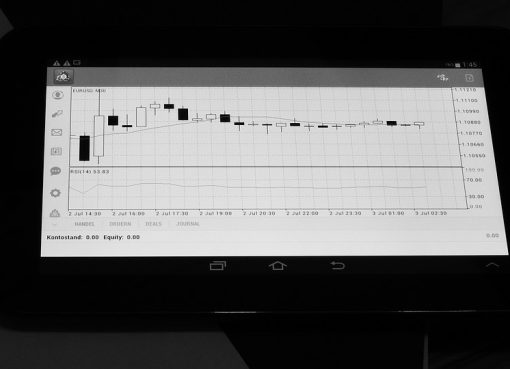

2. Technical Analysis: This involves analyzing stock price movements and trends using charts and technical indicators. Technical analysis can help investors identify entry and exit points for trades, as well as potential patterns that may signal future price movements.

3. Risk Management: It is essential for investors to manage their risk exposure by setting stop-loss orders, diversifying their portfolios, and avoiding emotional decision-making. This can help mitigate potential losses and improve overall trading performance.

Current Market Trends

The Australian stock market has shown resilience despite global economic uncertainties, driven by strong corporate earnings, government stimulus measures, and a rebound in commodity prices. Some current market trends worth noting include:

1. Growth in Technology Stocks: Australian technology stocks have been on the rise, fueled by increasing digitalization trends and demand for innovative solutions. Companies in sectors such as fintech, e-commerce, and cybersecurity are attracting significant investor interest.

2. Renewable Energy Sector: With a growing focus on sustainability and climate change, renewable energy stocks have gained traction in the Australian market. Companies involved in solar, wind, and battery storage technologies are positioned for long-term growth.

Trading Techniques and Platforms

There are various trading techniques that investors can utilize to enhance their trading performance, including day trading, swing trading, and long-term investing. Additionally, online trading platforms offer a convenient way to execute trades, access real-time market data, and monitor portfolio performance. Some popular trading platforms in Australia include CommSec, Bell Direct, and IG Markets.

Stock Analysis Methods

Stock analysis plays a crucial role in identifying investment opportunities and managing risks in the stock market. Common stock analysis methods include:

1. Financial Ratios: Analyzing key financial ratios such as price-to-earnings ratio, return on equity, and debt-to-equity ratio can provide insights into a company’s financial health and valuation.

2. Market Sentiment: Monitoring market sentiment through news and social media can help investors gauge market trends and investor sentiment towards specific stocks.

Tips for Successful Stock Trading in Australia

To succeed in stock trading in Australia, investors should consider the following tips:

1. Stay Informed: Keep abreast of market developments, economic indicators, and company news to make informed investment decisions.

2. Develop a Trading Plan: Set clear investment goals, risk tolerance, and trading strategies to guide your trading activities.

3. Diversify Your Portfolio: Spread your investments across different industries and asset classes to reduce risk and enhance returns.

In conclusion, trading stocks in Australia offers ample opportunities for investors to capitalize on the country’s dynamic market environment. By employing sound trading strategies, conducting thorough stock analysis, and staying informed about market trends, investors can navigate the stock market effectively and achieve their investment goals. Whether you are a seasoned trader or a novice investor, understanding the intricacies of stock trading in Australia can help you make informed decisions and build a successful investment portfolio.

Leave a Comment