Beyond the ASX: Uncovering Hidden Gems for Investment Success in Australia

Stock investment in Australia offers a lucrative opportunity for investors looking to diversify their portfolio and capitalize on the thriving Australian economy. With a stable political environment, strong regulatory framework, and well-developed financial markets, Australia has become a popular destination for both domestic and international investors.

Overview of the Australian Stock Market:

The Australian stock market is represented by the Australian Securities Exchange (ASX), which is one of the largest stock exchanges in the Asia Pacific region. The ASX lists over 2,000 companies, ranging from large-cap to small-cap stocks, across various sectors such as financial services, mining, healthcare, and technology. The ASX has a market capitalization of over $2 trillion, offering investors a wide range of investment opportunities.

Key Investment Opportunities:

Australia is known for its resource-rich economy, with the mining and energy sectors playing a significant role in the stock market. Companies such as BHP Billiton, Rio Tinto, and Woodside Petroleum are some of the key players in these industries. Additionally, Australia’s financial services sector is another attractive investment opportunity, with major banks such as Commonwealth Bank of Australia, Westpac Banking Corporation, and Australia and New Zealand Banking Group leading the way.

Current Market Trends:

In recent years, the Australian stock market has experienced significant growth, driven by strong economic fundamentals and robust corporate earnings. The technology sector, in particular, has seen a surge in interest, with companies like Afterpay, Xero, and Atlassian gaining popularity among investors. The renewable energy sector is also gaining momentum, with companies like AGL Energy and Origin Energy leading the charge towards a sustainable future.

Investment Strategies:

When investing in Australian equities, it is important to have a well-defined investment strategy that aligns with your financial goals and risk tolerance. Some common investment strategies include value investing, growth investing, and dividend investing. Diversification across sectors and market caps can also help mitigate risk and maximize returns.

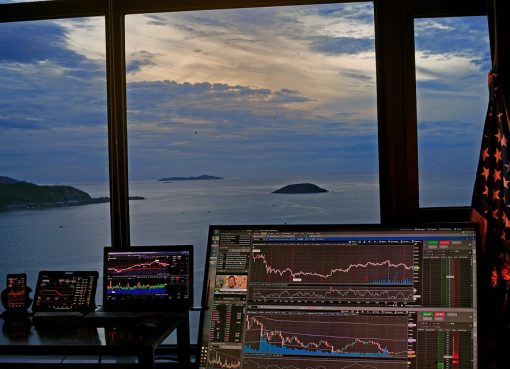

Performance Metrics and Stock Analysis:

When analyzing stocks in Australia, investors should consider key performance metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE). Technical analysis, which involves studying price trends and chart patterns, can also provide valuable insights into stock performance. Fundamental analysis, on the other hand, focuses on company financials, industry trends, and macroeconomic factors that impact stock prices.

Portfolio Management:

Effective portfolio management is essential for successful stock investing in Australia. Investors should regularly review their portfolio, rebalancing as needed to maintain diversification and manage risk. It is important to stay informed about market trends and company news that may impact stock performance. Utilizing tools such as stop-loss orders and trailing stops can help protect profits and minimize losses.

Financial Instruments for Stock Investment:

In Australia, investors have access to a wide range of financial instruments for stock investment, including individual stocks, exchange-traded funds (ETFs), and managed funds. ETFs are a popular choice for investors looking to diversify their portfolio and gain exposure to a specific sector or asset class. Managed funds, on the other hand, provide professional management and diversification across a range of assets.

Tips for Successful Stock Investing:

– Conduct thorough research before investing in any stock, including analyzing company financials, industry trends, and macroeconomic factors.

– Diversify your portfolio to spread risk across different sectors and asset classes.

– Stay informed about market trends and company news that may impact stock prices.

– Monitor your investments regularly and adjust your portfolio as needed to achieve your financial goals.

– Consider working with a financial advisor to develop a personalized investment strategy that aligns with your objectives.

In conclusion, stock investment in Australia offers a wealth of opportunities for savvy investors looking to capitalize on the country’s strong economy and vibrant stock market. By adopting sound investment strategies, conducting thorough stock analysis, and staying informed about market trends, investors can navigate the Australian stock market with confidence and achieve long-term financial success.

Leave a Comment