Making the Most of Market Trends: How to Capitalize on Opportunities in the Australian Stock Market

Stock investment in Australia is a popular and lucrative option for both domestic and international investors. The Australian stock market, also known as the Australian Securities Exchange (ASX), is one of the largest and most developed markets in the Asia-Pacific region. It offers a wide range of investment opportunities across various sectors, making it an attractive destination for investors looking to diversify their portfolio.

Overview of the Australian Stock Market:

The ASX is home to over 2,000 listed companies, including some of Australia’s largest and most well-known corporations such as BHP Group, Commonwealth Bank of Australia, and CSL Limited. The market is divided into various sectors such as financials, materials, healthcare, and consumer discretionary, providing investors with a broad range of options to choose from.

Key Investment Opportunities:

Australia is known for its strong resources sector, with companies in industries such as mining, energy, and agriculture playing a significant role in the economy. As a result, there are ample opportunities for investors looking to capitalize on the country’s natural resources.

In addition, Australia is also home to a vibrant technology sector, with companies like Afterpay, Xero, and Atlassian gaining traction in recent years. These tech companies offer investors exposure to the fast-growing digital economy, making them attractive investment options for those seeking growth opportunities.

Current Market Trends:

The Australian stock market has shown resilience in the face of the COVID-19 pandemic, with many sectors rebounding strongly from the initial market downturn in early 2020. The market has been buoyed by government stimulus measures, low interest rates, and a recovering economy, leading to positive investor sentiment.

Investment Strategies:

When investing in Australian stocks, it is important to adopt a diversified approach to minimize risk and maximize returns. One popular strategy is to invest in a mix of blue-chip stocks, growth stocks, and dividend-paying stocks to balance out the portfolio.

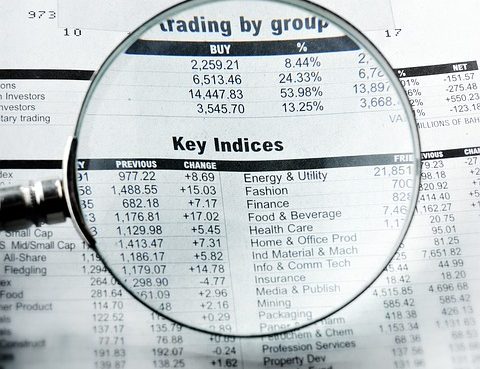

Performance Metrics and Stock Analysis:

Investors can use a variety of performance metrics and stock analysis tools to evaluate the potential of Australian equities. Some commonly used metrics include price-to-earnings ratio (P/E), earnings per share (EPS), and return on equity (ROE). Fundamental analysis, technical analysis, and market research can also provide valuable insights into the market and individual stocks.

Portfolio Management:

Effective portfolio management is crucial for successful stock investing in Australia. Investors should regularly review and rebalance their portfolios to align with their financial goals and risk tolerance. It is also important to stay informed about market developments and adjust investment strategies accordingly.

Financial Instruments for Stock Investment:

In addition to investing directly in individual stocks, investors in Australia can also access the market through exchange-traded funds (ETFs), managed funds, and options trading. These financial instruments provide alternative ways to gain exposure to the market and diversify investment portfolios.

Tips for Successful Stock Investing:

1. Conduct thorough research on companies and industries before making investment decisions.

2. Diversify your portfolio to spread out risk and maximize returns.

3. Stay informed about market trends, news, and economic indicators that may impact stock prices.

4. Set clear financial goals and create a long-term investment strategy.

5. Seek advice from financial advisors or professionals to gain insights into the market and investment opportunities.

In conclusion, stock investment in Australia offers a wealth of opportunities for investors seeking to grow their wealth and build a diversified portfolio. By understanding the market dynamics, utilizing investment strategies, and staying informed about market trends, investors can navigate the Australian stock market with confidence and achieve their financial goals.

Leave a Comment